Research Article: 2019 Vol: 23 Issue: 5

Measures of Sustainable Efficiency of Diversification of Motor Takaful For Less Privileged Inhabitants in Saudi Arabia

Shafiqul Hassan, College of Law, Prince Sultan University

Yusuff Jelili Amuda, College of Law, Prince Sultan University

Abstract

The general TakÄÂful has been growing in Saudi Arabia and attempt of the country to achieve vision 2030 calls for need to explore measures in diversifying motor TakÄÂful for the less privileged inhabitants in the country. The purpose of this paper is to painstakingly investigate different measures of sustainable efficiency of diversification of motor TakÄÂful for the benefit of less privileged inhabitants in the country. The method used in this paper is theoretical library-based paper galvanizing primary and secondary sources together using content analysis. The result indicated that there are identified dimensions or measures (governmental support, regulatory compliance, strategic investment in human capital, professional development and competitiveness) if properly utilised by the TakÄÂful industries in Saudi Arabia, they have positive potential in enhancing sustainable efficiency in diversifying of motor TakÄÂful for the benefit of less privileged inhabitants in the country. The implication of this study is that, the measures identified in this paper will serve as guides for policymakers, policy holders and more importantly it will provide a vista for an empirical assessment of measures in diversifying motor TakÄÂful for the less privileged inhabitants. In conclusion, it is mentioned that meaningful expansion of the TakÄÂful industry can be attained when different factors identified in this paper are considered as endogenous outcomes expected from motor TakÄÂful in maximizing opportunities for less privileged inhabitants in the country. It is therefore suggested that, the aforementioned variables should be empirically investigated among the promoters of TakÄÂful especially by Saudi Arabian Monetary Agency (SAMA) in order to constantly provide financial regulations in the country to as to fulfil the relevance and adaptability of Islamic financial system that makes its yardstick as accountability, transparency and uniformed regulations in the country.

Keywords

Sustainable Efficiency, Diversification, Motor Tak?ful and Less Privileged.

Introduction

There are a numbers of issues that pose challenges to global insurance markets. Of such challenges are: deregulation, competition, emergence of new risk, electronic commerce etc. Apart from these challenges, there are many other factors that have impact on insurance markets such as: regulatory system, system of insurance distribution among others. It is not deniable to posit that, literature contends that there is need for development of domestic financial industries as to respond to the proliferation of incentive of global insurers mainly to allow them have access to the markets (Shakir, 2000; Zaid, 2011). The improvement of financial system is one of the determinants of economic growth. Determining measures of sustainability of motor Tak?ful among less privileged inhabitants should demonstrate dynamism of Islamic insurance system for Saudi Arabia’s economy. This position is in line with rapid global economy.

Hence, there is need for effective protection of insurance and market reform industries rendering financial service in order to demonstrate free trade as mentioned by the World Trade Organization (WTO). It is essential to reiterate that, savings or involvement in motor Tak?ful by the participants should be transformed into investment in order to promote economic growth as literature contends (Arena, 2008). In so doing, productivity of Tak?ful capital is paramount so as to address the financial challenges of less privileged inhabitants. The role of bank or financier institution in spurring capital stock productivity is efficient in driving the investment output.

Undoubtedly, efficiency should be directly linked with the competitiveness of the financial industries. In this regard, the new technologies can play an effective role for the diversification of motor Tak?ful for the less privilege inhabitants in Saudi Arabia (Zaid, 2011). As the global economy thrives, many countries grow in their insurance system but in the case of Saudi Arabia, the country has not adequately benefited from the improvement on the insurance scheme. In other words, in the context of Saudi Arabia, prior to 2004, insurance industry was not given proper attention it deserved specifically, it was such an unstructured in its operation. The need for its reform made government to give it a priority when Saudi Arabian Monetary Agency (SAMA) was empowered in providing international standard to the insurance industry in the country. The previous researchers contend that, in spite of the global development in insurance or Tak?ful, Literature such as Zaid (2011) notes that social and legal factors are factors that affect the operation of conventional insurance industry in the country. This therefore gave the room for the operation of Tak?ful as against life insurance advocated for in the conventional insurance.

The reform in insurance industry in Saudi Arabia started in 2004 whereby the study by Zaid (2011) identified that there is high rate of growth especially in health insurance and motor insurance for mainly the expatriates and employees in Saudi Arabia. The percentage in motor insurance as at 2009 was accounted for 21% within the general Tak?ful which was low compared to premiums of 50% for health insurance as literature contends (The Saudi Insurance Market Report, 2009). As a result of low rate of growth in motor Tak?ful, this remains a gap that this study attempts to fill up in order to showcase the measures in diversifying motor Tak?ful for the less privileged inhabitants in the context of Saudi Arabia.

As regards to insurance in Saudi Arabia, Protection and Savings are commonly recognised; however, there is new orientation and fresh mind-set that brought about change in customers’ perception in utilizing compulsory insurance most especially health and motor insurance as a result of the fact that they recognize the benefits of Tak?ful in purchasing Protection and Savings. After few years in the reforms in insurance industry, it is essential to investigate different measures of motor Tak?ful not meant for expatriates and employees in Saudi but for the less privileged inhabitants in the country. As the industry may plan for further reform in the nearest future, this research is important in identifying various measures that will further enhance the operation of diversification of motor Tak?ful for the less privileged inhabitants in order to meet up with the international standards in the practice of Tak?ful.

Theoretical Overview

The need for hosting human development index from the viewpoint of Islamic paradigm has been extensively discussed by experts in Islamic economic system (Haqq, 1995; Anto, 2010). Determining the discourse on the paradigm shift for sustainable economic development in the Muslim countries have been established in the literature (Astrom, 2011) as an attempt to make Islamic economic system relevant to the contemporary needs of the Muslims. Chapra (2009) extensively elucidated on the relevance of Ibn Khaldun’s historical philosophy in contextualizing Islamic economic development in the modern period. Islamic insurance is an integral financial instrument useful in addressing socio-economic problems of the society especially in reducing poverty (Al-Nemer, 2013).

Undoubtedly, the historical trend of Islamic insurance was traceable to the 2nd century of Islamic era. This was when Arab Muslims expanded their trade transaction to India and many other Asian countries specifically when there was initiation of joint or cooperative guarantee among some individuals to help each other in the period of perils (Mehdi, 2010). Literature identifies that Ottoman Empire used the same joint guarantee with Spanish merchants. For instance, it is noted in the existing literature that Waqf was used judiciously in providing basic insurance within the empire. In the 19th century, there were different insurance models employed by the Empire, nonetheless, there was reform in the classical Islamic insurance mainly to make it relevant to the needs of Muslims. Nevertheless, the subsequent stagnation of Islamic jurisprudence emanating from colonialism in different parts of the Muslim countries affected the flourish of regulatory framework of Islamic banking and finance as literature expounds (Mehdi, 2010; Al-Amri, 2014).

However, it was after independence that most Muslim countries began to realise the need to address various economic challenges and they looked inwardly to examine the Islamic heritage in order to be able to address multifarious problems. The remarkable trend in the modern insurance was traceable to the late 17th Century in England with the establishment of fire insurance (Mehdi, 2010). Subsequently, there various economic models and mathematical theories upon which insurance models were based on. As a result, for many years, Muslims used the modern western models to address their economic challenges. Since the early 1970s, the questionability of permissibility of conventional insurance largely contributed to the emergence in the discourse of Islamic insurance because, for example, Grand Council of Ulama of Saudi Arabia has unanimously illegalized the conventional insurance as a result of the presence of different elements such as: uncertainty, interest and gambling (Gharib, 2007). Also, the general presidency of scholary and IFTA in Saudi Arabia (2001) as well as the international Islamic Fiqhi Academy (2007) provided Shari’ah basis for the regulation of Tak?ful in the predominant Muslim countries.

Thus, Tak?ful has been considered as an alternative insurance to conventional insurance and it has been in use in many aspects since few decades ago. Literature acknowledges that Tak?ful has a potential in reducing poverty (Mughal, 2008). However, little attention is given to the utilization of motor Tak?ful on less privileged inhabitants such as poor and needy as an attempt to reduce poverty as mentioned in many studies (Mughal, 2008, AlNemir, 2013). In other words, there is less focus on the dimensions of efficiency of legal diversification of motor Tak?ful in the context of Saudi Arabia. Despite the fact that Tak?ful is growing, there is still a gap in the existing literature (Ismail et al., 2011) in determining sustainable measures of efficiency in the Tak?ful industry as part of addressing its challenges and navigating its future direction as being explored in the existing literature (Mohd Fauzi et al., 2014). This is important in order to conceptually develop dimension of efficiency for diversification of motor Tak?ful towards helping the less privileged inhabitants in the country. Therefore, there is need to bridge this gap by demonstrating measures of sustainable efficiency in motor Tak?ful in the context of Saudi Arabia.

Therefore, the justification of this study are in two folds namely: First, to strengthen internal investment by the government by catering for less privileged inhabitants. Second, to promote overall efficiency of legal diversification in motor Tak?ful in the country. This should be regarded as a new strategy in enhancing Islamic banking and finance especially in harmonizing it with regulatory compliance and consequently realizing the growth in the industry in the country. As a result, we limit our scope to certain factors that would make us assess efficiency of Tak?ful in order to improve motor Tak?ful for the conditions of less privileged inhabitants in Saudi Arabia. In other words, this study will meaningfully contribute to process and implementation of Tak?ful through measures of sustainable efficacy for legal diversification of motor Tak?ful among less privileged inhabitants in the country. It is thereby important to briefly explain of Tak?ful in the Saudi Arabia.

An Overview of Tak?ful in Saudi Arabia

Tak?ful has been growing in different parts of the world including Saudi Arabia (Billah, 2007). Studies posit that Tak?ful is considered as mutual or cooperative insurance whereby its operation is based on Shari’ah principles (Maysami & Kwon, 1999; Yusof, 2000; Taylor, 2004). Sabbir (2004) contends that:

“Takaful is the form of insurance deemed permissible for Muslims under Shari’ah Law (Islamic Law). The fundamental philosophy of Takaful is the same as that of the cooperative, with added restrictions on investments and more flexibility on capital formation. The Takaful is operated as an enterprise providing services on a self-sustaining model rather than as a charity (P.8)”.

The above is explicit with regard to the basic philosophy of Tak?ful which is more of rendering service to the participants than regarding it as charity. However, there are aspects of similarities and difference with conventional insurance especially in the aspect of regulatory framework. Conventional insurance is based on the western secular models while Islamic insurance (Tak?ful) is based on Shari’ah framework. This is why Aris, (n.d.) regards Tak?ful as an alternative to conventional insurance. It is in this regard that, literature asserts that, most Muslim countries need to understand the regulatory framework of Islamic insurance in order to address socio-economic challenges of the society (Fisher, 2000).

Furthermore, several studies have extensively examined the regulatory framework for the growth of the industry in spite of the challenges in in the uniformity of the regulatory framework (Michael et al., 2007). Literature has discussed that Tak?ful is serving both charity and business purposes by the micro-insurance providers (Brown & Churchill, 1999; Altuntas et al., 2011). On one hand, for the purpose of charity, it can be used for catering for the needs of poor and the needy inhabitants. On the other hand, it is used to maximize profit through various Tak?ful products whereby the premiums are distributed among the participants (Brown and Churchill, 1999).

Onwards, the development of Tak?ful started since 1977 in Saudi Arabia in order to provide Shari’ah based insurance to the participants (Alhumoudi, 2012). However, reform of insurance industry started precisely in 2004 in order to provide guide for the industry in meeting up with the international standards (Zaid, 2011). Thus, sustainable efficiency of regulations or legality of general Tak?ful or specific motor Tak?ful is important in diversifying motor Tak?ful in the context of Saudi Arabia. Most studies on efficiency of Tak?ful in predominant Muslim countries like Malaysia focus much on the life insurance (Saeed et al., 2006). The study by Zaid (2011) posits that companies dealing with life insurance attempt to facilitate long term investments. Studies such as Kader et al. (2010) have emphatically stressed on the exploration of efficiency and its application in various organizations such as Tak?ful industry. Literature identifies that there are total numbers of thirty five insurance companies such as: SABB Tak?ful, Al-Ahli Tak?ful, etc. which are registered with SAMA in the country (Zaid, 2011).

Saudi Arabia has been expanding its growth in the Tak?ful industry since few years ago especially after reform in its insurance reform in 2004 (Zaid, 2011). Then, in the discourse and trend of Tak?ful have shifted from historical view and Shari’ah compliance to viability and efficiency of Tak?ful. Nonetheless, there are challenges with respect to the measures of efficiency in Tak?ful industry in relation with the Shari’ah compliance. Undoubtedly, literature such as Al-Amri (2014) contends that, Saudi Arabia has been playing vital role among members of Gulf Cooperation Council (GCC) namely: United Arab Emirate (UAE), Qatar, Oman, Kuwait and Bahrain. Banking services as an integral part of financial services are central economic growth among GCC including Saudi Arabia. It is in line with this assertion that literature contends that, insurance market contributes meaningfully to the economic growth (Ward and Zurbruegg, 2008; Arena, 2008). It is not disputable to posit that despite the fact that the government of Saudi Arabia has been trying to improve its activities in financial sector. However, Tak?ful industry still needs more effort in improving it for essential benefits the citizens such as poor and needy deserve. In spite of the evolvement of Tak?ful industry, the experts still raise the issue of paramount importance of Shari’ah compliance in the activities of Tak?ful as literature expounds (Hamid and Othman, 2009).

The country is considered as the largest market for Tak?ful industry because it harnessed the resource of USD 4.3 billion constituting 51.8% share of the global Tak?ful (Zaid, 2011). It is must be reiterated that, between 2007 and 2012, there is drastic growth of Tak?ful which is an indication that there are more potentialities towards expanding the Tak?ful industry in the country by putting necessary mechanism in place. Notably, literature contends that, contributions gathered from Tak?ful reached USD 18.3 billion in the second half of the year 2013. In spite of this, there are still many prospects for its growth in the Muslim countries in general and Saudi Arabia in particular. Clyde & Co (2015) contends that:

“The considerable population growth of recent years has put pressure on the government to design and implement significant infrastructural and social projects. These investment projects, and financial and investment growth in KSA generally, received support from the Saudi Arabian Monetary Agency (SAMA) which continued to regularly introduce and update financial and banking legislation to support the country’s strategic economic plans. One relevant piece of legislation introduced by SAMA is that all insurance companies operating in KSA have to follow a cooperative business model that is seen to be slightly different from the widely-used Takaful model, but whose ultimate objective is to introduce a Sharia compliant business model for the insurance business.”

The above quotation is explicit with regard to the model expected by insurance companies to adhere to in the context of Saudi Arabia. However, there is need for incorporation of Tak?ful non-profit making target, that is to say, family and general Tak?ful must be further expanded towards giving necessary support to the less privileged inhabitants, who find it tough to get a source of income in the country (Brown and Churchill, 1999). In this regard, for instance, it can be considered as a way of replicating the micro-insurance market established in Indonesia to cater for the poor and needy. In similar vein, it is deducible to say that, motor Tak?ful in Saudi Arabia can also serve this purpose among the less privileged inhabitants in the country in order to cater for the needs of poor people as an integral part of general Tak?ful identified by Malaysian Tak?ful Association (2017). In an attempt to do such, it is important to put necessary mechanisms in place for its proper functioning as literature such as Brown and Churchill, (1999) contends that micro-insurance plays an important role in the provision of insurance to low income households. This can be done through the exploration and conceptualization overview of measures or dimensions of sustainable efficiency in diversifying motor Tak?ful in the country. The subsequent sub-heading explains this.

Measures of Sustainable Efficiency of Diversification of Motor Tak?ful

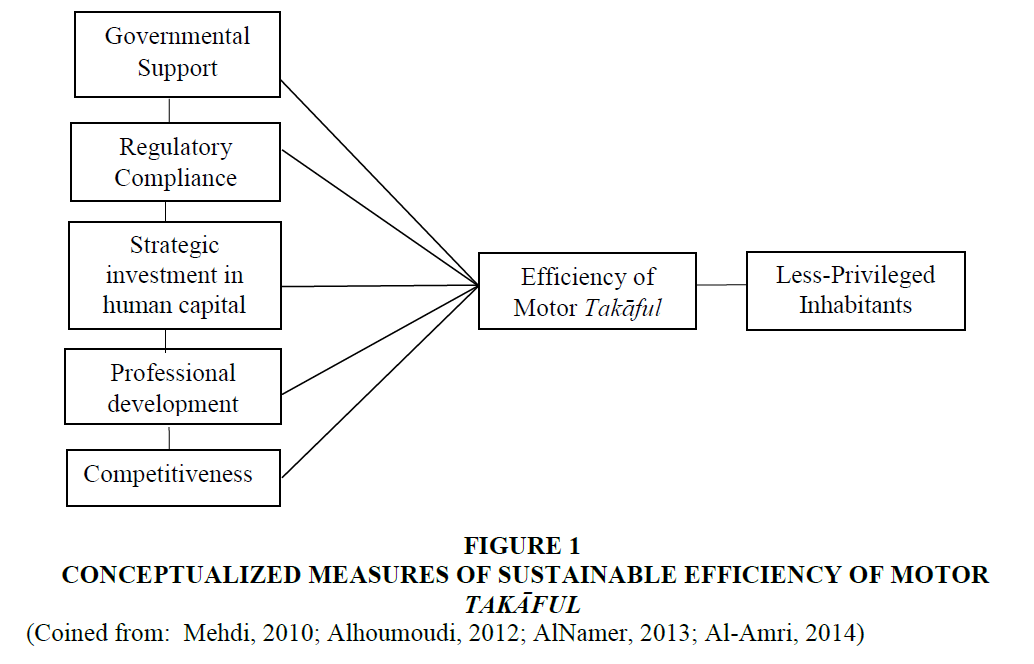

Tak?ful in general and motor Tak?ful in particular are considered as an integral part of financial services. Financial services play paramount roles for an expansion of economic growth in a given society as literature contends (Arena, 2008). Literature has explored the efficiency of Tak?ful companies and despite of its evolvement, there are various challenges faced by it such as: profitability, proliferation, quality among others (Saad et al., 2006; Alhomoudi, 2012). Less attention is given to expansion of different dimensions of efficiency in motor Tak?ful n the context of Saudi Arabia. It is therefore significant to determine the measures of sustainable efficiency in motor Tak?ful in Saudi Arabia. Undoubtedly, there are a number of conceptualised factors to be considered as measures of sustainable efficiency which are: governmental support, regulatory compliance, strategic investment in human capital, professional development and competitiveness.

First, governmental support in the operation of Tak?ful is paramount in achieving sustainable efficiency of the industry in the context of Saudi because without government’s permission for operation of insurance, Tak?ful companies will find it so difficult to function properly. This has been demonstrated in the industry’s reform when the government empowered Saudi Arabian Monetary Agency (SAMA) to control the industry by considering it matching the international Standard (Zaid, 2011). It is noteworthy to say there are over thirty four licensed insurance companies with premium estimated at USD 6.87. Also, AlRajih Tak?ful (2011) has provided policy for comprehensive car insurance in the country. In addition, studies such as AlNamer (2013) found out that the government has been supporting Tak?ful industry as a mechanism for reducing poverty. Saudi Arabian Monetary Agency (SAMA) has been playing significant role in providing regulation to the insurance companies in the country. In addition, in 2013, the government has given the Executive Regulations on shipping it requires compulsory policy on insurance. More specifically, Mehdi (2010) contends that sustainability of efficiency in Islamic banking and finance in general and motor Tak?ful in particular require funds from the government in conducting quality research that its outcome will surely provide a roadmap for the policy strategies in enhancing the efficiency of Tak?ful.

Second, pertaining to the regulatory compliance, the study by Mehdi (2010) contends that in the predominant Muslim countries, Malaysia has been leading in the aspect of best regulatory compliance in the Tak?ful industry. Nonetheless, Gulf Cooperation Council (GCC) countries have been striving towards improving the Tak?ful through the provision of essential regulations. More importantly, Saudi Arabian Monetary Agency (SAMA) (2003b) has provided law mainly for the supervision of activities of cooperative insurance companies in the country. Notably, insurance policy has also been provided by the Saudi Arabian Monetary Agency (SAMA) (2003a) whereby Implementing Regulations on Insurance Policy states as follows:

“Legal document/contract issued to the insured by the insurer setting out the terms of the contract to indemnify the insured for loss and damages covered by the policy against a premium paid by the insured”

Onwards, studies such as Hodgins and Beswetherick (2009) acknowledged that, the government has been trying to provide insurance regulation in the country. The government has saddled the responsibility of issuing the license to insurers by Saudi Arabian Monetary Agency (SAMA) which provides comprehensive policy on Tak?ful. Prior to the issuance of license, it is required that SAMA should have to data or information of a particular insurance company. In addition, the country has put in place Supervision of Co-operative Insurance Companies which was promulgated by Royal Decree M/5 dated 17/5/1405 (1983) as literature explains. Similarly, the government has provided different regulations such as: Implementing Regulations (2003). Insurance Intermediaries Regulation (2011), Online Insurance Activities Regulation (2011), Investment Regulation (2012). More importantly, the provision of the Unified Compulsory Motor Insurance Policy (2012) remains an essential policy for the actualization of efficiency of motor Tak?ful in the country. Similarly, Tak?ful operators have paramount roles to ply with respect to solvency of insurance (Yakob et al., 2012). In addition, Shari’ah compliance has been considered as an important part in discussing regulatory framework. This is why Hamid & Othman (2009) found out that the level of knowledge and understanding of various concepts as well as Arabic and Shari’ah terms are significant in the discourse of Tak?ful especially in relation with the issuance of Tak?ful license. Yazid et al., (2012) provides Shari’ah basis as one of the major determinants of demand for Tak?ful products. Hence, there is need to further expand this in order to accommodate motor Tak?ful for less privileged inhabitants in the country as an attempt to provide sustainable efficiency in diversifying Tak?ful. The aforementioned regulations are regarded as insurance policies within the framework of regulations..

Third, strategic investment in human capital is important for the success and efficiency of Tak?ful. This is so, in Islam, human welfare is given priority over economic welfare. However, the essence of economic welfare is to fulfil human needs. It is noteworthy to say that literature contends that, economic development is necessary; nonetheless, it cannot guarantee the overall human wellbeing (Mirakhor & Askari, 2010). It should be reiterated that, human capital is the basic bedrock upon which economic development can be attained. Investment in human capital should centrally focus on the aspect of education, health, income as literature expounds (Haqq, 1995; Chapra, 1999; Asrom, 2011). An inference can therefore be made that, an emphasis on the utilization of motor Tak?ful in bringing a betterment to the life of less-privileged inhabitants in Saudi Arabia is a major aspect of investment in human capital development. Negligence of human capital can undermine the overall development as one of the main targets to achieve vision 2030 in the country. It can therefore be inferred that, catering for the less privileged inhabitants in Saudi is an attempt to provide a renewed focus on the resource distribution in order to promote equity among the citizens in general and less privileged in particular.

Fourth, professional development is an essential factor in discussing efficiency in the operation of Tak?ful industry. Regarding the professional development, there are three sub-components that need to be explicated which are: the cost-efficiency of non-life Tak?ful, technical efficiency and allocative efficiency as identified in the study by Al-Amri (2014). Cost-efficiency refers to the ration of cost and the extent by which funds is mobilised or galvanised for effective running of non-life Tak?ful by a particular firm or industry. It is noted that the functions of workers and separation between functions of chief executive officer and chairman is not making significant improvement on the cost-efficiency in running Tak?ful industry (Kader, Adams and Hardwick, 2010). In addition, technical efficiency determines the extent of utilizing technological gadget as the input in order to maximize output of Tak?ful products. It is also used to determine either in increase or decrease the production or activity of an industry. It is noteworthy to say that, there is an inadequate technical efficiency in Tak?ful as compared to conventional insurance. Onwards, allocative efficiency refers to the extent by which management of Tak?ful try to harmonize the inputs in achieving the target of a particular Tak?ful firm (Al-Amri, 2012). In this regard, literature argues that, the impact of forms of organization and efficiency play significant role in the integration of family Tak?ful and life insurance in predominant Muslim countries like Malaysia (Ismail et al., 2011). It is can deduced that, improvement on the organization and efficiency in the aspect of professionalism of Tak?ful firms in Saudi Arabia can make impactful effect on the social economic status of the less privileged inhabitants. It is on this basis that, Jaffer (2011) contends that, attention to family Tak?ful can bring meaningful growth to the industry.

Fifth, competitiveness is also essential in order to achieve efficiency or effectiveness of motor Tak?ful. It is important to posit that, literature notes that Saudi Arabia has been able to showcase the diversification of motor Tak?ful specifically in the aspects of strategies for investment, investment in deposits, mutual funds and debt securities (Al-Amri, 2014). An emphasis on this can greatly promote competitiveness in motor Tak?ful especially for the less privileged inhabitants in the country. It is, in addition, important to stress on the dynamism and competitiveness of Tak?ful industry in the country in order to favourably compete with countries like Malaysia in South-East Asia and many other GCC countries that provide conducive environment for Tak?ful market in order to cater for needs of the poor and the needy by establishing micro-insurance similar to its operation in Indonesia. Notably, the common products of Tak?ful in predominant countries of GCC are in motor and health products as literature expounds (Clyde and Co, 2015). More specifically, literature contends that United Arab Emirate (UAE) has been able to diversify both general and family Tak?ful products among GCC countries. It is not arguable to posit that Saudi Arabia is one of leading countries with great potentials in expanding the market of Tak?ful products despite the fact motor Tak?ful is considered as slow growing insurance in the country as literature explicates (Zaid, 2011). The five-common measures of sustainable efficiency of Tak?ful have been elaborated and expanded beyond cost, technical and allocative efficiencies identified in the study by Al-Amri (2014). Figure 1 shows conceptualized measures of sustainable efficiency of Tak?ful explicitly explicated in this paper.

Figure 1:Conceptualized Measures Of Sustainable Efficiency Of Motor Takaful

(Coined from: Mehdi, 2010; Alhoumoudi, 2012; AlNamer, 2013; Al-Amri, 2014).

Conclusion

This paper lucidly investigated Tak?ful in general and motor Tak?ful in particular in Saudi Arabia as a result of the fact that it has been evolving in terms of regulations. The proliferation of the insurance companies is a testimony to the development Tak?ful in the country. The paper mentions that there are different theoretical and practical studies that focus much of different aspects of Tak?ful especially conceptual basis. Studies have also investigated motor Tak?ful in Saudi Arabia, however, this paper bridges the gap in the earlier studies by bringing a five-common-factor together as dimensions or measures of efficiency in Tak?ful industry as an integral part of diversification of motor Tak?ful for the less privileged inhabitants. It is argued that the government’s support in the aspect of funds for research can expand the scope of Tak?ful beyond its current potential which is an important factor for promoting or fostering efficiency of broadening Tak?ful in the contemporary time. Similarly, it has been explored that, investment in human capital especially in impacting the lives of less privileged inhabitants through the provision of motor Tak?ful can further entrenched the viability and feasibility of Tak?ful in the country. In spite of minimal studies on measure of efficiency of Tak?ful, this paper has meticulously elaborated different sub-components-cost (efficiency of non-life Tak?ful, technical efficiency and allocative efficiency) to be emphasized on as an integral part of professional development in the Tak?ful industry. It is also noted that there is need for dynamism and competitiveness of Tak?ful product in the market of which it is explicitly mentioned in several studies that Saudi Arabia is a potential market for Tak?ful. Harmonization of the five-common factor into general and family Tak?ful insurance identified in this paper which will bring about efficiency and it will create synergy between the operators of Tak?ful and the less privileged inhabitants in the country. This has been better improved since 2004 when there was reform in insurance company especially when SAMA was empowered to provide a guide for the Tak?ful industries through the lens of international standards.s

References

- Al-Amri, K. (2014). Takaful insurance efficiency in the GCC countries. Emerald Journal of Humanities, 31(3), 344-353.

- Al-Amri, K., Gattoufi, S., & Al-Muharrami, S. (2012). Analyzing the technical efficiency of insurance companies in GCC. The Journal of Risk Finance, 13(4), 362-380.

- Alhomoudi, Y.A. (2012). Islamic Insurance Takaful and its applications in Saudi Arabia. A Thesis Submitted for the Degree of Doctor of Philosophy at Brunel University.

- AlNemer, H.A. (2013). Poverty in Saudi Arabia, the way to reduce: An empirical study on Takaful participants. Paper presented at the 5th Islamic Economic System Conference 2013, Berjaya Times Square Hotel, Kuala Lumpur: Malaysia.

- AlRajhi Takaful (2011). Insurance policy for comprehensive car insurance. Published by Alrajhi Takaful Company

- Altuntas, M., Berry-Stölzle, T.R., & Erlbeck, A. (2011). Takaful- charity or business? Field study evidence from micro-insurance providers. Journal of Insurance Regulation, 30, 339-358.

- Anto, M.B.H. (2010). Introducing an Islamic human development index (I-HDI) to measure economic development in OIC countries. Islamic Economic Studies, 19(2), 69-94.

- Arena, M. (2008). Does insurance market activity promote economic growth? A cross-country study for industrialized and developing countries. The Journal of risk management, 75(4), 921-946.

- Aström, Z.H. (2011). Paradigm shift for sustainable development: The contribution of Islamic economics. Journal of Economic and Social Studies, 1(1), 73-82.

- Billah, M.M. (2007). Islamic banking and the growth of Takaful? in Hassan, M.K. and Lewis, M.K. (Eds), the Handbook of Islamic Banking, Elgar, Cheltenham, pp. 401-418.

- Brown, W., & Churchill, C. (1999). Micro-Insurance: Providing Insurance to Low-Income Households Part a Primer on Insurance Principles and Products. Microenterprise Best Practices Project, (Development Alternatives Inc., Bethesda, MD, 1999), www.mip.org/pubs/mbpdef.htm.

- Chapra, M.U. (1999). Islam and economic development: A discussion within the framework of Ibn Khaldun?s Philosophy of History, Proceedings of the Second Harvard University Forum on Islamic Finance: Islamic Finance into the 21st Century Cambridge, Massachusetts, Center for Middle Eastern Studies, Harvard University, pp.23-30.

- Clyde & Co (2015). Insurance & Reinsurance in Saudi Arabia: An Overview. Clyde & Co LLP is a limited liability partnership registered in England and Wales. Authorised and regulated by the Solicitors Regulation Authority. Retrieved from www.clydeco.com on 18/8/2019.

- Fisher, O.C. (2000). Awakening of a Sleeping Giant-Rediscovery of Takaful Worldwide. Directory of Islamic Insurance (Takaful), (Institute of Islamic Banking & Insurance, 2000).

- Gharib El Gammal (2007). Commercial Insurance and Islamic Alternative, Dar El Eatesam Edition 2007, Cairo.

- Hamid, M.A., & Othman, M.S. (2009). A study on the level of knowledge and understanding among muslims towards the concepts, Arabic and Shariah terms in Islamic insurance (Takaful). European Journal of Social Sciences, 10(3), 468-478.

- Haq, M. (1995). Reflections on Human Development. Oxford University Press: New York.

- Hodgins, P., & Beswetherick, M. (2009). Insurance Regulation in the Kingdom of Saudi Arabia, Clyde & co, International Law Firm. Retrieved from: http://www.clydeco.com/knowledge/articles/insurance-in-the-kingdom-of-saudiarabia.cfm,

- Ismail, N., Alhabshi, D.S.O., & Bacha, O. (2011). Organizational form and efficiency: The coexistence of family takaful and life insurance in Malaysia. Journal of Global Business and Economics, 3 (1), 122-137.

- Jaffer, S. (2011). Family Takaful: Creating new growth dimensions for Takaful industry. Quarterly Journal to Financial Bridges, Autumn, 2-3. Retrieved from http://www.milliman.com/uploadedFiles/insight/life- published/family-takaful.pdf

- Kader, H.A., Adams, M., & Hardwick, P. (2010). The cost efficiency of Takaful insurance companies. The Geneva Papers on Risk and Insurance-Issues and Practice, 35(1), 161-181.

- Malaysian Takaful Association - Listing. (2017). Retrieved from http://www.malaysiantakaful.com.my/Consumer Zone/FAQs/Listing.aspx?cat=Family-Takaful

- Maysami, R.C., & Kwon, W.J. (1999). An analysis of Islamic Takaful insurance-a cooperative insurance mechanism. Journal of Insurance Regulation, 18, 109-132.

- Mehdi, S. (2010). The evolution of Islamic insurance - Takaful: A literature survey. Insurance Markets and Companies, 1(2), 100-107.

- Ainley, M., Mashayekhi, A., Hicks, R., Rahman, A., & Ravalia, A. (2007). Islamic Finance in the UK: Regulation and Challenges. Retrieved from https://www.isfin.net/sites/isfin.com/files/islamic_finance_in _the_uk.pdf

- Mirakhor, A., & Askari, H. (2010). Islam and the Path to Human and Economic Development. New York: Palgrave Macmillan.

- Mohd Fauzi A.H. et al. (2014). Takaful (Islamic Insurance) Industry in Malaysia and the Arab gulf states: Challenges and future direction. Asian Social Science. 10(21)

- Mughal, Z. (2008). Takaful can greatly help in reducing poverty. Economic Review (05318955); 39(2/3), 21-22.

- Saad, N.M., Majid, M.S.A., Yusof, R.M., Duasa, J., & Rahman, A.R.A. (2006). Measuring efficiency of insurance and Takaful companies in Malaysia using data envelopment analysis (DEA). Review of Islamic Economics, 10(2), 5-26.

- Sabbir, P. (2004). Takaful and poverty alleviation. The International Cooperative and Mutual Insurance Federation (ICMIF), Altrincham: United Kingdom.

- Saudi Arabia Monetary Agency SAMA (2003). The Implementing Regulations of the Law on Supervision of Cooperative Health Insurance. Retrieved from http://www.cchi.gov.sa/en/Rules/Documents/Rules%20 and%20Regulations.pdf on 15-08-2019.

- Saudi Arabia Monetary Agency SAMA (2003). Law on Supervision of Cooperative Insurance Companies. Retrieved from http://www.sama.gov.sa/sites/samaen/Insurance/InssuranceLib/4600_C_InsuraLaw_ En_2005_08_17_V1.pdf.

- Shakir, I., (2000). Revisiting Islamic Financial Products. Directory of Islamic Insurance (Takaful), (Institute of Islamic Banking & Insurance).

- Taylor, D.Y. (2004). Takaful Ta?awuni and the differences and similarities with mutual or cooperative insurance. paper presented at International Cooperative and Mutual Insurance Federation Mutuality Seminar held in Tunis, 21 May, Tunisia.

- The General Presidency of Scholary and IFTA in Saudi Arabia (2001). Decision no (5/10) Insurance subject. Retrieved from http://www.alifta.net/Fatawa/fatawaDetails.aspx?BookID=1&View=Page&PageNo=1 &PageID=410.

- The International Islamic Fiqhi Academy (2007). Conference no 18 Malaysia. Retrieved from http://www. fiqhacademy.org.sa/Malaysia-q18.pdf

- Wahab, A.R.A., Lewis, M.K., & Hassan, M.K. (2007). Islamic Takaful: Business models, Shariah concerns, and proposed solutions. Thunderbird International Business Review, 49(3), 371-396.

- Aris, Y.B.W. (n.d.). Takaful - An option to conventional insurance: A Malaysian Model. Staff Working Paper, Faculty of Business and Management, Universiti Teknology MARA, 1-23. Retrieved from kantakji.com website: http://www.kantakji.com/fiqh/Files/Insurance/n100.pdf

- Yakob, R., Yusop, Z., Radam, A., & Ismail, N. (2012). Solvency determinants of conventional life insurers and Takaful operators. Asia-Pacific Journal of Risk and Insurance, 6(2).

- Yazid, A.S., Arifin, J., Hussin, M.R., & Daud, W.N.W. (2012). Determinants of family Takaful (Islamic life insurance) demand: a conceptual framework for a Malaysian study. International Journal of Business and Management, 7(6), 115.

- Yusof, F.M.D. (2000). The concept & operation of Takaful. Directory of Islamic Insurance (Takaful), (Institute of Islamic Banking & Insurance, 2000).

- Zaid, A.A. (2011). Analysis of the impact of reforms on insurance industry of Saudi Arabia. Interdisciplinary Journal of Research in Business, 1(8), 28-37.